CBMTRA Tax Reform Act to save US Craft Brewers millions of dollars

Breweries, Wineries and distilled spirits producers to benefit across America

On 20th December 2017, the 115th United States Congress passed H.R.1, the Tax Cuts and Jobs Act. Included in this legislation is the Craft Beverage Modernization and Tax Reform Act (CBMTRA), which lowers the federal excise tax for breweries, wineries and distilled spirits producers.

On 20th December 2017, the 115th United States Congress passed H.R.1, the Tax Cuts and Jobs Act. Included in this legislation is the Craft Beverage Modernization and Tax Reform Act (CBMTRA), which lowers the federal excise tax for breweries, wineries and distilled spirits producers.

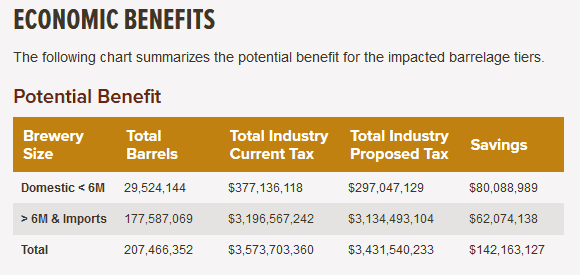

Under the bill, the federal excise tax on beer will be reduced by 50% to $3.50/barrel (from $7/barrel) on the first 60,000 barrels for domestic brewers producing less than 2 million barrels annually, and reduced to $16/barrel (from $18/barrel) on the first 6 million barrels for all other brewers and all beer importers. The bill maintains the current $18/barrel rate for barrelage over 6 million. In total, this represents more than $142 million in annual savings, which will allow America’s small brewers—who are manufacturers and entrepreneurs—to reinvest in their businesses, expand their operations, and hire more workers.

Additionally, CBMTRA increases collaboration between brewers by permitting transfer of beer between bonded facilities without tax liability.

The effort to bring meaningful federal excise tax relief to small brewers has been a primary political objective for the Brewers Association (BA) of which IC Filling Systems is a member, for almost 10 years. The BA has played a central role within the beverage alcohol coalition, advocating for this historic change in public policy. The BA, as an organization advocating on behalf of small brewers, has a commitment to its members to influence change when and where it can, without taking a position on larger legislation.

This bipartisan legislation is a tremendous step forward for America’s small brewers, located in almost every congressional district in the nation. Speaking yesterday, Bob Pease, President and CEO of BA, stated that

"The Association would like to thank Congress, especially Sens. Portman (R-OH), Blunt (R-MO), and Wyden (D-OR), and Reps. Paulsen (R-MN) and Kind (D-WI), for their leadership and support of America’s small and independent breweries. Small brewers are the growth engine in this industry, and our expectation is that CBMTRA will spur additional growth in the months and years ahead."

The provisions of this bill are effective from January 1, 2018.

More information about CBMTRA can be found at BrewersAssociation.org. Specific information pertaining to the impacts of the full tax bill will be communicated to BA members in due course.

Reacting to the news, Managing Director of IC Filling Systems Inc of Santa Rosa, California, Giovanni Solferini, had this to say:

"The passing of the CBMTRA legislation is fantastic news for the hard working artisan beer, wine and spirits producers of America. I hope it will both encourage and financially make it easier for further investment in capacity and productivity. We have supplied bottling equipment for craft beer producers, winemakers and spirits producers in America since 1994, and with this welcome news, we are looking forward to 2018 as being truly a vintage year."